II. The Allo Ecosystem: Pillars and Principles

2.1. The Three Pillars: A Synergistic Approach

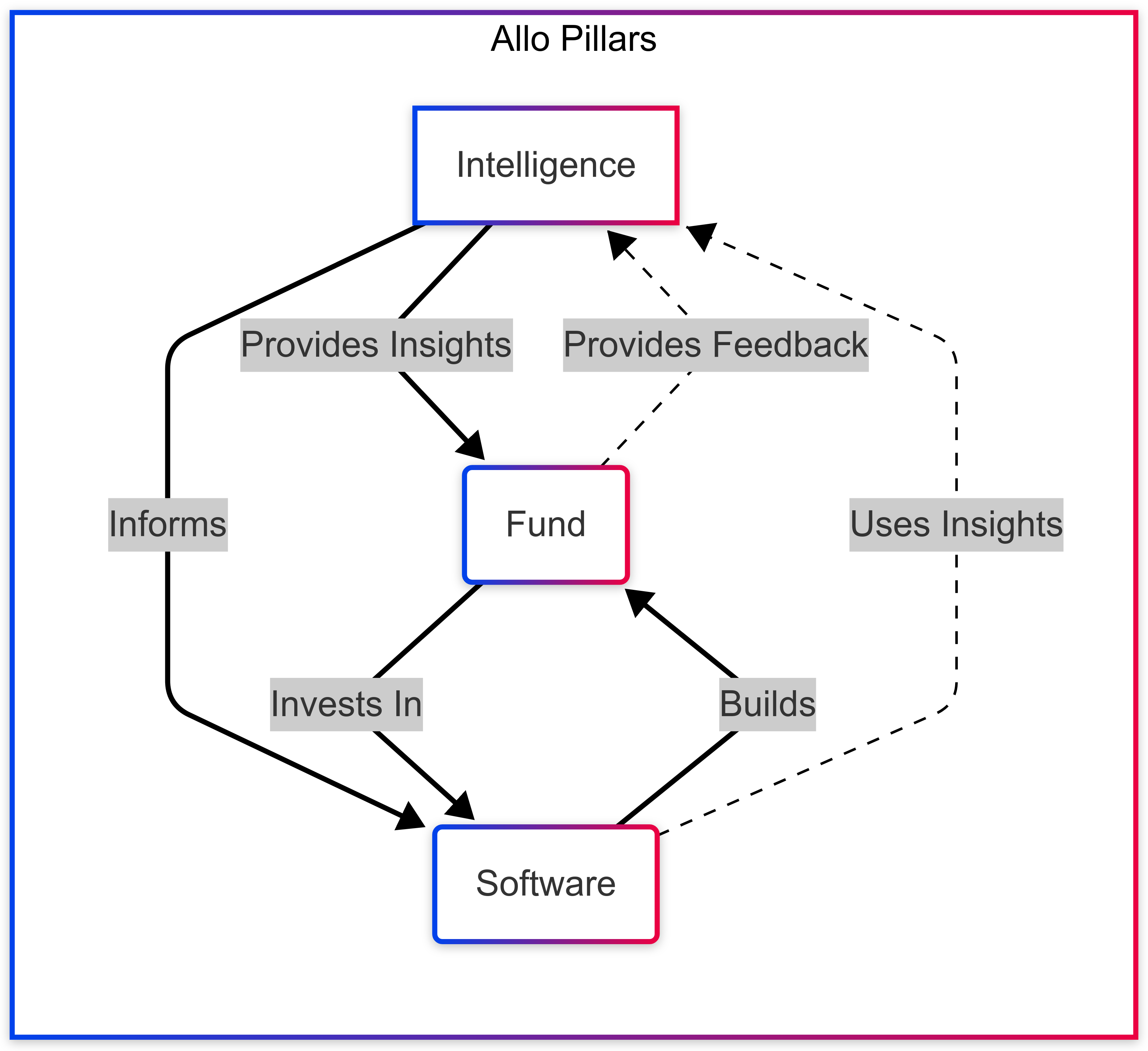

Allo.Capital's operations are structured around three core pillars: Intelligence, Software, and Fund. These pillars are not isolated silos; they are interconnected and synergistic, working together to create a comprehensive and self-reinforcing ecosystem for onchain capital allocation. Each pillar informs and supports the others, creating a virtuous cycle of innovation and growth.

2.1.1. Intelligence: Researching and Defining the Future of Capital Allocation

The Intelligence Pillar serves as Allo.Capital's research and development arm. Its primary mission is to explore the frontier of onchain capital allocation, identify promising new mechanisms, develop the theoretical frameworks that underpin Allo's operations, and disseminate knowledge to the broader community. This pillar acts as the brain of Allo.Capital, constantly learning, adapting, and pushing the boundaries of what's possible.

Key Functions

- Category Creation: Defining and establishing "onchain capital allocation" as a distinct and vital field within the broader web3 ecosystem. This involves producing thought leadership, engaging with industry stakeholders, and promoting the adoption of Allo's mechanisms and frameworks. It means actively shaping the narrative and establishing Allo.Capital as the leader in this emerging space.

- Mechanism Design: Developing and refining new and existing capital allocation mechanisms, drawing on insights from economics, game theory, mechanism design, computer science, and other relevant disciplines. This involves rigorous theoretical analysis, modeling, and simulation to ensure that mechanisms are effective, efficient, and resilient.

- Data Analysis: Rigorously analyzing onchain data to understand the behavior of different mechanisms, identify trends, detect anomalies, and evaluate the effectiveness of various funding strategies. This data-driven approach informs the continuous improvement of Allo's tools and protocols, ensuring they are optimized for real-world performance.

- Thought Leadership: Sharing research findings and insights with the broader community through publications, blog posts, presentations, workshops, and the Allo.Research forum. This fosters transparency, encourages collaboration, and promotes the adoption of best practices in onchain capital allocation.

- Community Building: Cultivating a vibrant research community around Allo.Capital, attracting top researchers, developers, and thinkers to contribute to the ecosystem. This involves organizing events, facilitating collaborations, and providing resources and support to researchers.

- Allo.Research: This Discourse-style forum facilitates all of the above key functions. It is a hub to discover open RFPs, share research ideas, submit research proposals, access resources, collaborate with peers, and engage in discussions.

Key Research Areas - Q1 2025

- Enshrining Public Goods Funding: Investigating ways to make public goods funding more systematic, sustainable, and less reliant on individual donations or short-term grants. This includes exploring mechanisms for "enshrining" funding within protocols or platforms, creating dedicated revenue streams for essential public goods.

- Decentralizing Ethereum Community Funding: Developing improved mechanisms for funding Ethereum ecosystem projects, with a focus on decentralization, transparency, and community governance. This involves exploring the DEEFF (Decentralizing Ethereum Ecosystem Funding Flows) concept to create a more modular and pluralistic funding approach.

- Deep Funding-Related Research: Improving and expanding upon the Deep Funding mechanism, exploring its potential applications and addressing its limitations.

- AI and Capital Allocation: Investigating the use of AI agents for capital allocation, including the development of AlloNets (a conceptual framework). Exploring how AI can enhance decision-making, automate processes, and optimize resource distribution within DAOs and other onchain entities.

- Social Safety Nets in an Onchain/AI World: Considering how to build safety nets in a world where AI and onchain systems play an increasingly significant role, ensuring equitable access to resources and opportunities.

- Friction Points in Capital Allocation: Identifying and addressing the most common challenges and inefficiencies in current capital allocation systems, both in traditional finance and within the web3 space.

The Allo Research Program: Submission and Review Process

The Allo Research Program is a structured framework that will enable researchers to meaningfully contribute to the Intelligence Pillar. This process is currently a work-in-progress and subject to change as we work through the potentials and tensions in Q1. The current flow consists of:

- RFP Publication or Proposal Submission

- Initial Screening

- Community Discussion

- Signal Voting

- Allo Team Evaluation

- Selection and Funding

- Progress Tracking

- Deliverable Submission

- Final Review and Publication

Research Reports: Cadence, Distribution, and Impact

The Intelligence Pillar will produce regular monthly research reports that summarize key findings, insights, and recommendations, and will be distributed widely.

Knowledge Management: Systems and Practices for Organizing and Sharing Research

The Intelligence Pillar is committed to:

- Open Repositories

- Standardized Templates

- Tagging and Categorization

- Open Access

Open Questions for Community Discussion

- How can we best structure the $ALLO token rewards for researchers to align long-term incentives?

- What metrics should be used to evaluate the impact of research, and how can we track them onchain?

- What mechanisms can be implemented to ensure the quality and objectivity of research funded by the DAO?

- How can we encourage interdisciplinary collaboration within the research community?

- What are the most effective ways to disseminate research findings and engage the broader community?

2.1.2. Software: Building the Infrastructure for Abundance

The Software Pillar is the engine room of Allo.Capital, responsible for building and maintaining the technical infrastructure that powers the entire ecosystem. This includes the core Allo Protocol, as well as a suite of user-friendly tools and applications designed to make onchain capital allocation accessible to developers, funders, and communities. This pillar translates the theoretical insights of the Intelligence Pillar into practical, real-world tools.

Key Components

- Allo Protocol: The foundational smart contract protocol that enables the creation and management of diverse onchain funding mechanisms. It's designed to be flexible, secure, extensible, and adaptable to a wide range of use cases. The protocol acts as the core "engine" for all capital allocation activities within the Allo ecosystem.

- Proof of Flow: A gamified staking mechanism that allows token holders to signal their support for projects and earn rewards. (See Section IV.5 for a detailed explanation). Proof of Flow serves as a key mechanism for community engagement, project discovery, and signal generation.

- Allo Kit: A modular framework and set of developer tools (libraries, SDKs, APIs) that make it easy for developers to integrate Allo's mechanisms into their own applications or build entirely new dApps on top of the Allo Protocol. This fosters a vibrant ecosystem of applications built on Allo's infrastructure.

- Simple Grants: A user-friendly platform for creating and managing grant programs, simplifying the process of distributing funds to deserving projects. It provides a streamlined interface for both grant program organizers and applicants.

- Allo.Expert: A dedicated platform serving as a knowledge hub and schelling point for the content of the Onchain Capital Allocation Handbook. It offers registries of mechanisms, experts, and training materials, making it a central resource for anyone interested in learning about or contributing to this field.

- Allo.Gold: An experimental platform under development, envisioned as a one-stop shop to deploy any capital allocation circuit. It aims to provide a user-friendly interface for creating and managing various funding mechanisms, potentially incorporating an AI interface to further reduce cognitive load.

- Allo IRL: A web application designed to bridge the gap between in-person events and onchain capital allocation. It allows for easy participation in Allo voting experiences with minimal crypto onboarding, using QR/NFC codes and email sign-up.

Future Software Initiatives

- Improving Existing Mechanisms: Continuously iterating on existing mechanisms (like QF, Retro PGF, and Proof of Flow) based on data, community feedback, and research from the Intelligence Pillar.

- Developing New Mechanisms: Exploring and prototyping new mechanisms for onchain capital allocation, drawing on insights from the Intelligence Pillar and the broader research community.

- Enhanced Developer Tools: Creating more powerful and user-friendly tools for developers building on Allo, including improved documentation and educational resources.

- Cross-Chain Compatibility: Expanding Allo's reach by making its mechanisms compatible with multiple blockchain networks.

- Integration with Other Protocols: Building integrations with other DeFi and web3 protocols to create a more seamless and interoperable ecosystem.

- Advanced Analytics and Reporting: Developing sophisticated tools for tracking and analyzing the performance of different mechanisms.

Open Questions for Community Discussion

- What are the most promising new mechanisms for onchain capital allocation, and how can Allo best support their development?

- How can Allo's developer tools be further improved to attract and retain builders?

- What are the key challenges and opportunities in achieving cross-chain compatibility, and how should Allo prioritize its efforts in this area?

- What kind of simulation environments can we build to test new Allo mechanisms?

- What are the most important features and functionalities that should be prioritized in the development of Allo's software tools?

- How can we ensure that Allo's tools are accessible and user-friendly for both developers and non-technical users?

- What are the best strategies for fostering a vibrant developer community around Allo?

2.1.3. Fund: Investing in the Builders of the New Oasis

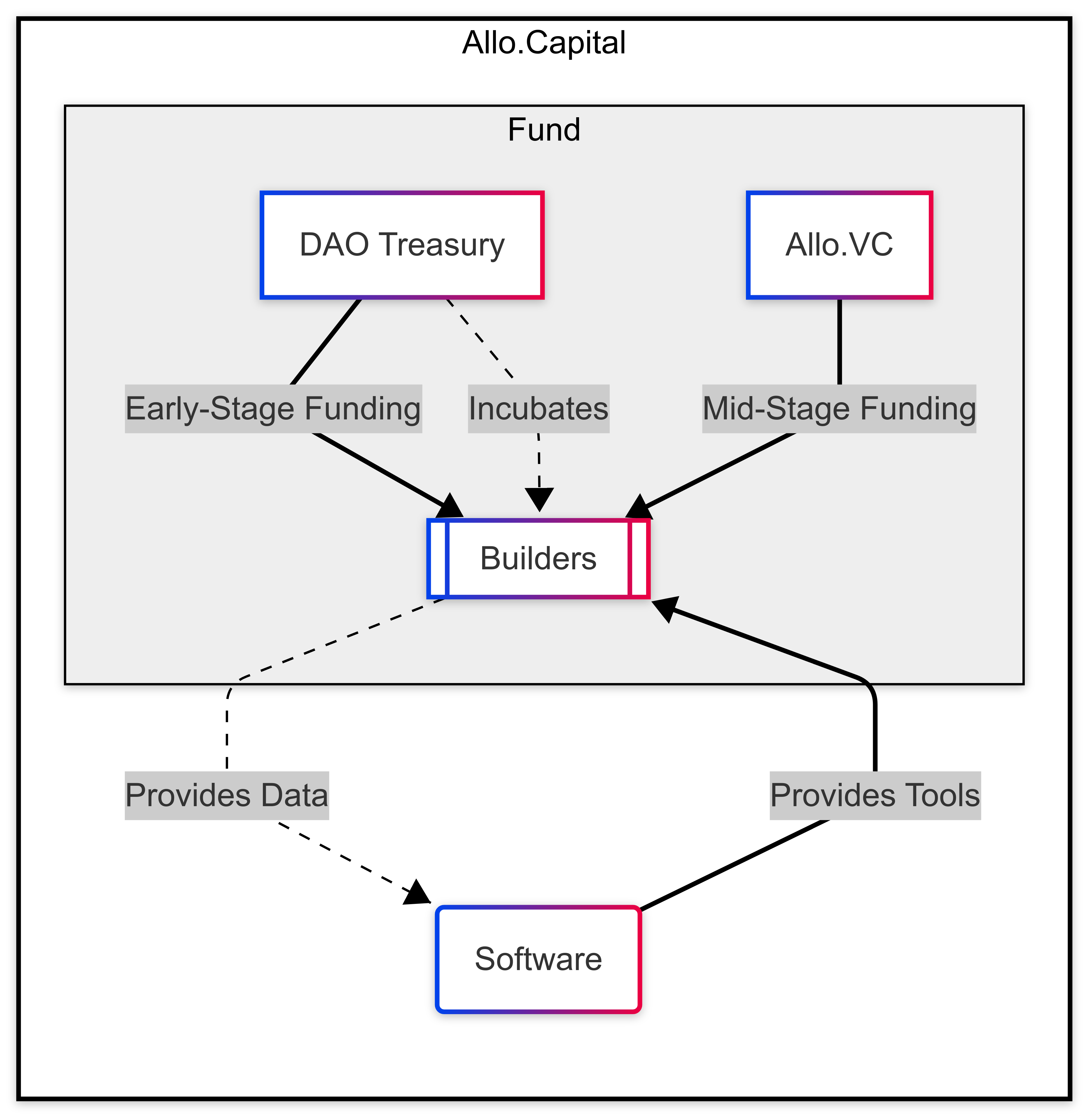

The Fund Pillar is the investment arm of Allo.Capital, providing direct financial support to projects that are building on or contributing to the Allo ecosystem. It acts as a catalyst, providing the necessary resources to accelerate the growth of promising initiatives. It operates through two distinct, yet connected, vehicles:

- DAO Treasury: Provides early-stage funding for community-led projects, research initiatives, and contributor rewards. This funding is governed by the Allo DAO and utilizes mechanisms like token swaps, protocol fees, and potentially revenue from Revnets (if implemented). The DAO Treasury focuses on incubating new ideas, fostering a pipeline of innovative projects, and supporting the core operations of the Allo ecosystem. It's the "seed fund" of the Allo ecosystem.

- Allo.VC (Evergreen Fund): A professionally managed venture capital fund that invests in mid-stage, high-growth projects that have demonstrated traction and market fit. This fund operates independently of the DAO, making its own investment decisions based on traditional VC principles, but maintains alignment with the DAO through carry-sharing and token incentives. The fund has not yet finalized whether it will be open or closed-ended, with both options presenting different advantages. Allo.VC provides a pathway for projects to access larger amounts of capital and expertise, accelerating their growth and impact, and providing a bridge to traditional venture capital.

Relationship to the Broader Ecosystem

The Fund is not just a source of capital; it's an active participant in the Allo ecosystem. The Fund works closely with the Intelligence and Software Pillars, creating a synergistic relationship:

- The Intelligence Pillar provides research and insights that inform the Fund's investment decisions, helping to identify high-potential projects and emerging trends. This includes evaluating the effectiveness of different capital allocation mechanisms and identifying promising areas for investment.

- The Software Pillar provides the technical infrastructure and tools that enable the Fund to operate efficiently and transparently, and that enable the projects being funded to thrive. This includes the Allo Protocol, Proof of Flow, and other tools that facilitate onchain funding and community engagement.

- The Fund, in turn, supports the growth of projects that are building on Allo's software and contributing to the overall ecosystem, creating a virtuous cycle. The Fund also provides valuable feedback to both the Intelligence and Software pillars, based on its real-world experience working with projects.

Investment Thesis and Strategy

The Fund's investment thesis is centered on the belief that onchain capital allocation will be a defining feature of the tokenized internet. The Fund seeks to invest in projects that are:

- Mission-Aligned: Projects that share Allo's vision of creating a more equitable, transparent, and efficient system of capital allocation. This includes projects that are building on the Allo Protocol, developing new capital allocation mechanisms, contributing to public goods, or otherwise advancing the field of onchain finance.

- Technically Sound: Projects with strong technical foundations and experienced development teams. This includes projects with well-designed smart contracts, secure infrastructure, and a clear understanding of the technical challenges and opportunities in the web3 space.

- Community-Focused: Projects that prioritize community engagement and governance. This includes projects that are actively building communities, soliciting feedback, and incorporating community input into their development process.

- Scalable: Projects with the potential to reach a large audience and have a significant impact on the ecosystem. This includes projects with strong network effects, clear paths to monetization, and the potential to become self-sustaining.

Fund Structure and Operations

The Allo.VC fund will have a professional management team (GPs) responsible for sourcing, evaluating, and managing investments. The DAO will maintain oversight over the DAO Treasury. Details of fund structure will evolve with the formation of the Allo DAO.

Open Questions for Community Discussion

- What specific criteria should the Fund use to evaluate potential investments?

- How can the Fund best support its portfolio companies beyond providing capital?

- What mechanisms can be implemented to ensure alignment between the Fund and the broader Allo community?

- Open or Closed-ended Fund: Which structure aligns better with Allo's long-term vision and the community's expectations for continuous innovation versus defined investment periods?

- How will the DAO oversee the Fund's activities without stifling its agility and independence?

2.2. Core Principles: Guiding Allo's Mission

Allo.Capital is guided by the following core principles, which inform all its activities and decision-making processes across all three pillars:

- Decentralization: Empowering communities through distributed governance and ownership. Allo is committed to transitioning to a DAO model, where $ALLO token holders have a direct say in the governance of the protocol.

- Transparency: Ensuring open access to information and decision-making processes. Allo believes that open-source development, onchain data, and clear communication are essential for building trust.

- Efficiency: Streamlining capital allocation to minimize friction and maximize impact. Allo strives to create funding mechanisms that are as efficient as possible.

- Impact: Focusing on funding public goods and projects that have a positive social and environmental impact.

- Sustainability: Building long-term, regenerative systems for funding innovation. Allo is committed to building mechanisms that are sustainable over time.

- Collaboration: Fostering a collaborative environment where individuals and organizations can work together to achieve shared goals.

- Community-Driven: Prioritizing the needs and input of the community in all aspects of Allo's operations.

- Equitable: Ensuring that funding opportunities are accessible to all, regardless of background or connections.

- Regenerative: Designing systems that create positive feedback loops, where success breeds further success.

- Constructive: Focusing on building and creating value, rather than extracting it.

- Empowering: Providing individuals and communities with the tools and resources they need to thrive.

- Ethical: Adhering to the highest ethical standards in all of Allo's activities.

2.3. The DAO of DAOs Vision: Interconnected Ecosystems of Abundance

Allo.Capital envisions a future where Decentralized Autonomous Organizations (DAOs) are not isolated entities, but interconnected nodes in a vast network of collaboration and mutual support. This "DAO of DAOs" model represents a shift from competition to practical pluralism, where organizations thrive through cooperation and interoperability.

[Diagram 3: graphics from Owocki’s DAO of DAOs post]

This interconnected network will operate on three levels:

- Social Layer Interoperability: Building trust and relationships through shared events, knowledge sharing, and community engagement. Examples include cross-DAO participation in conferences, joint workshops, and shared communication channels.

- Technology Layer Interoperability: Creating compatible systems and shared infrastructure, allowing DAOs to seamlessly interact and build upon each other's work. This could involve DAOs building on top of Allo Protocol, using common tools, or integrating with each other's platforms.

- Governance Rights Interoperability: Sharing decision-making power and resources through mutual grants, shared incubation programs, and reciprocal governance rights. This might involve DAOs holding each other's tokens, participating in joint funding rounds, or having representatives on each other's governance councils.

This interconnected network will create a more resilient, collaborative, and impactful ecosystem.

Examples of DAO of DAOs in Action

- Gitcoin DAO partnering with other DAOs on joint grant rounds.

- DAOs using Allo Protocol to fund projects that benefit multiple ecosystems.

- DAOs participating in Proof of Flow, staking tokens on projects providing shared infrastructure.

Open Questions for Community Discussion

- What are the most effective mechanisms for fostering social, technical, and governance interoperability between DAOs?

- How can we incentivize DAOs to participate in the DAO of DAOs network?

- What are the best practices for managing a DAO of DAOs, and what tools are needed to support this?

- How can we address the challenges of governance complexity, potential conflicts, and security risks in a DAO of DAOs?

2.4. The Fountain: Community OS

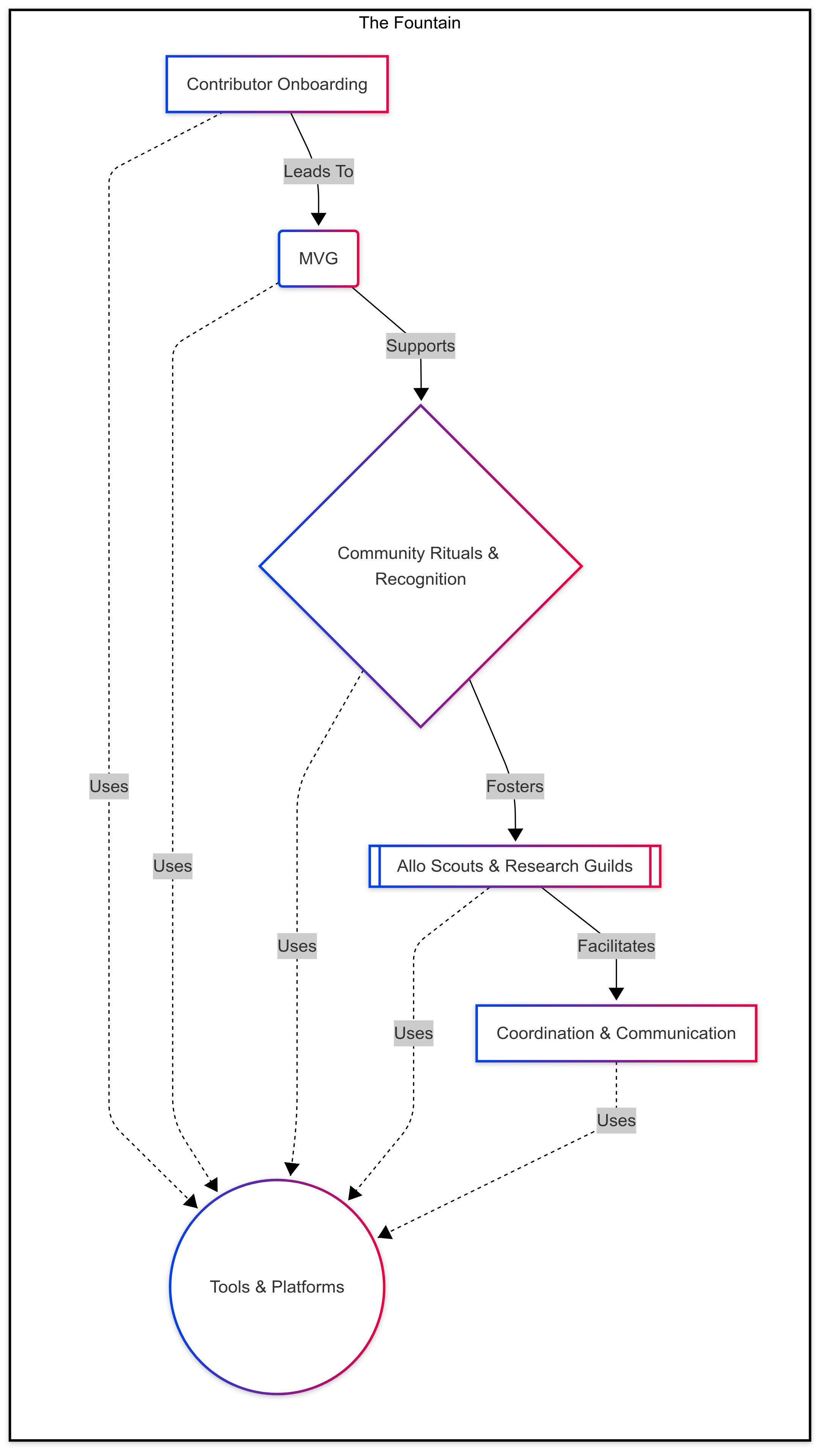

"The Fountain" represents the foundational community operating system (OS) of the Allo DAO. It is envisioned as a set of tools, platforms, and processes that facilitate governance, onboarding, and community engagement. The Fountain is designed to embody the principles of Minimal Viable Governance (MVG), prioritizing efficiency, autonomy, and participation, over excessive bureaucracy.

Key Functions of The Fountain

- Contributor Onboarding: Streamlining the process for new contributors to join the DAO, understand its mission, and find ways to participate meaningfully. This could involve creating clear pathways for engagement, providing educational resources, and matching contributors with relevant projects or teams.

- Minimal Viable Governance (MVG): Implementing governance processes that are lightweight, time-boxed, and focused on strategic decision-making. This helps prevent governance bloat and ensures that the DAO remains agile and responsive. It means focusing DAO-wide votes on essential decisions and delegating authority where appropriate.

- Community Rituals & Recognition: Maintaining the culture and lore of the DAO through regular events, ceremonies, and recognition programs. This helps foster a sense of belonging, shared identity, and long-term engagement.

- Allo Scouts & Research Guilds: Facilitating decentralized deal flow and community intelligence gathering. The Research Guilds would be a component of the Intelligence Pillar.

- Coordination and Communication: Providing tools and platforms for effective communication and coordination among DAO members. This could include forums, chat channels, project management tools, and regular community calls.

Open Questions for Community Discussion

- What specific tools and platforms should be included in The Fountain? (e.g., Snapshot for voting, Discourse for forums, Telegram for chat, Coordinape for rewards, SourceCred-style tools for contributions, GitHub for code management).

- How can we ensure that The Fountain remains lightweight and avoids governance bloat?

- What mechanisms can be used to effectively onboard new contributors and guide them towards meaningful participation?

- How can we balance the need for efficiency with the desire for inclusivity and broad participation in governance?

- What are the best ways to foster a strong sense of community and shared purpose within the DAO?

- How can we design the OS to be composable with the "DAO of DAOs" concept?